Major markets rallied Tuesday, hitting an upswing in the roller coaster ride that President Donald Trump's trade policies have sent the market on in recent weeks.

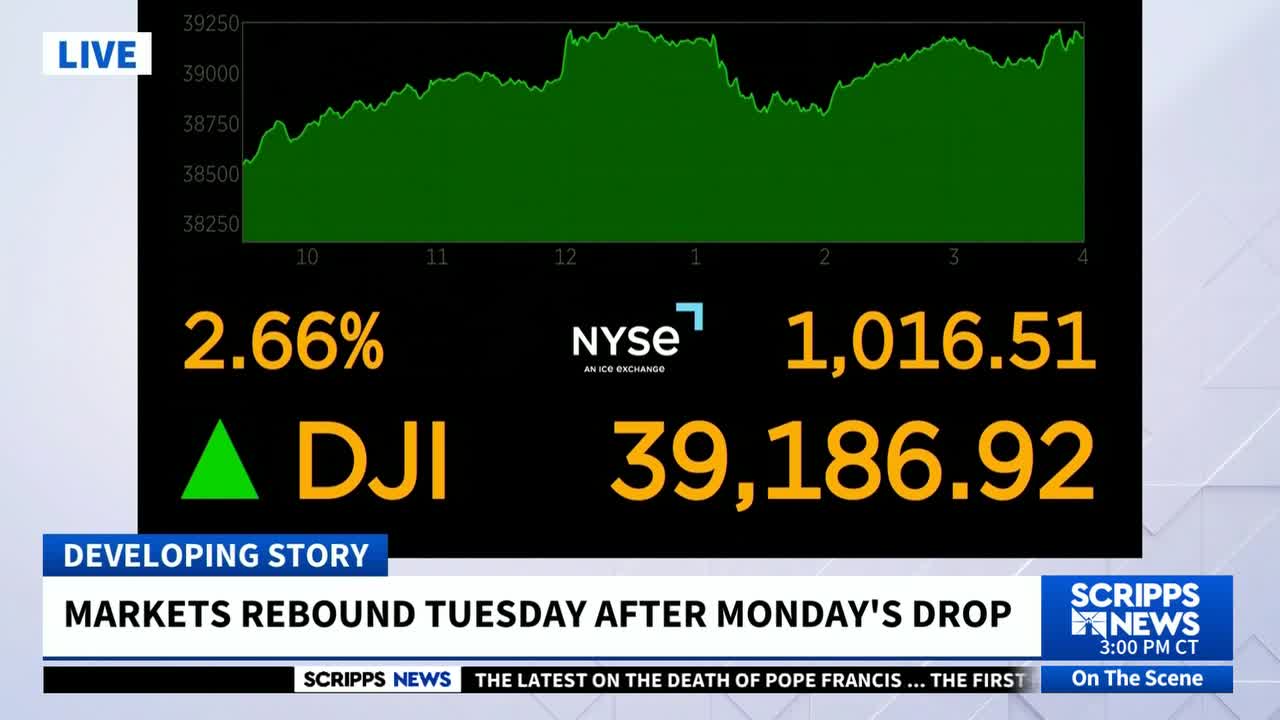

The Dow Jones Industrial Average gained more than 1,000 points, up 2.72% just a day after losing more than 900 points. The S&P 500 closed up 2.46% and the Nasdaq climbed 2.71%.

The Dow Jones has mostly been in decline over the last month as President Donald Trump's economic policies have brought angst among investors. Among President Trump's policies, a global 10% tariff, in addition to 145% duties on imports from China, has raised questions about the future of the U.S. economy.

The Dow Jones Industrial Average was close to hitting 45,000 in February before declining to below 38,000 earlier this month. As of the close on Tuesday, it remained above 38,500.

RELATED STORY | 'Hit hard': Tariffs add pressure to coffee prices already on the rise

Several stocks that saw weeks of significant declines, such as Amazon, Apple, Walmart, and Nike, had solid rebounds on Tuesday. The rebound comes one day after President Trump met with representatives from Walmart, Target, Lowe's, and Home Depot regarding economic policy.

The Dow's jump comes despite concerns expressed by the International Monetary Fund in its World Economic Outlook, which was released on Tuesday. In it, economists say global economic activity is likely to slow in the coming year due to President Trump's policies.

"Intensifying downside risks dominate the outlook," the report states. "Ratcheting up a trade war, along with even more elevated trade policy uncertainty, could further reduce near- and long-term growth, while eroded policy buffers weaken resilience to future shocks. Divergent and rapidly shifting policy stances or deteriorating sentiment could trigger additional repricing of assets beyond what took place after the announcement of sweeping U.S. tariffs on April 2 and sharp adjustments in foreign exchange rates and capital flows, especially for economies already facing debt distress."

RELATED STORY | Read the full list of countries facing Trump's reciprocal tariffs

On Tuesday, Treasury Secretary Scott Bessent reportedly said a "de-escalation" of tariffs on China was possible, because the existing policies would not be sustainable.

“I do say China is going to be a slog in terms of the negotiations,” Bessent said, according to a transcript of a speech, reported on by The Associated Press. “Neither side thinks the status quo is sustainable.”